Technical Analysis of The Financial Markets — 31 March 2021 | Capital Street FX

Asian stocks were on the backfoot on Wednesday. The Shanghai composite is down 0.43% at 3,441.91. Overall, the Singapore MSCI down 1.07% at 359.30. Over in Hong Kong, the Hang Seng Index down 0.29% to 28,442. In Japan, the Nikkei 225 down 1.02% at 29,180, while the Topix index is down 1.21% at 1954.0. South Korea’s Kospi down 0.28% to 3061.42. Australia S&P/ASX 200 up 0.78% at 6790.7.

European equities Tuesday closing. The DAX futures contract in Germany traded 1.29% up at 15008.61, CAC 40 futures up 0.06% at 6092.0 and the UK 100 futures contract in the U.K. down 0.03% at 6,770.5.

In U.S. on Wall Street, the Dow Jones Industrial Average closed 0.31% down at 33067.0, the S&P 500 down 0.32% to 3958.6 and the Nasdaq 100 down 0.53% at 12896.5, NYSE closes at 15626.10 up 0.09%.

In the Forex market, GBPUSD up 0.12% at 1.37556. The USDJPY up 0.29% at 110.661. The USDCHF up 0.05% at 0.94240. EURUSD up 0.15% at 1.17323, EUR/GBP up 0.04% at 0.85293. The USD/CNY down 0.23% at 6.5569, at the time of writing.

In the commodity market U.S Gold futures up 0.05% at $1,686.72. Elsewhere, Silver futures up 0.76% to $24.164 per ounce, Platinum up 1.78% at $1173.33 per ounce, and Palladium up 1.16% to $2,619.50.

Crude Oil mix on Wednesday; Brent crude oil up 1.13% to $64.68 barrel while U.S. West Texas Intermediate (CLc1) is down 1.50% at $61.20.

In the Cryptocurrency Markets, BTCUSD at 59514.21 up 1.28%, Ethereum at 1850.21 up 0.44%, Litecoin at 196.84 up 0.54%, at the time of writing.

TOP STOCKS TO WATCH OUT TODAY:

DISCOVERY Inc. up 5.382% at $37.01, GAP Inc. up 4.694% at $30.11, AMERICAN AIRLINES up 5.282% at $24.12, S&P GLOBAL Inc. down 2.477% at $352.78, BAIDU Inc. up 6.61% at $218.23, TESLA Inc. up 3.98% at $635.62, APPLE Inc. down 1.227% at $119.90, AMGEN Inc. down 2.043% at $249.75.

Economic news:

US: President Joe Biden will unveil his vision for a mass ramp-up in U.S. infrastructure spending Wednesday in Pittsburgh, a city the White House views as a prime example of an old manufacturing hub revitalized by new industries from health care to technology.

The administration wants the same type of reorientation that Pittsburgh saw to provide fresh opportunities to working-class cities and towns across the country. While the president’s plan does feature traditional road, bridge and airport projects, the package also includes items like high-speed broadband, along with long-neglected priorities to update the electrical grid, replace lead pipes in homes and schools and retrofit and weatherize commercial buildings.

Brian Deese, one of Biden’s top economic aides, told senior congressional Democrats on Tuesday that the infrastructure package would amount to about $2 trillion over eight years, according to a person familiar with the discussion. The proposal is vastly bigger in size and breadth than the nation’s last long-term infrastructure bill — a $305 billion, five-year surface-transportation initiative in 2015.

Eurozone: A financial services cooperation pact agreed by Britain and the European Union to enable regulators to share information forsees two meetings a year and stops short of any substantive reference to market access, a document showed on Tuesday.

Britain left the EU’s orbit on Dec. 31, cutting the City of London from its largest export customer.

The pact had not been expected to create a forum for deciding on market access as this will up to Brussels granting “equivalence” for specific financial activities.

But the four-page memorandum of understanding seen by Reuters makes scant reference to access, saying that both sides will “jointly endeavour to pursue a robust and ambitious bilateral regulatory cooperation”.

Important Data: UK GDP (QoQ) (Q4) today at 2:00 this time estimated 1.0%, previously which was 16.0%. EURO ZONE CPI (MoM) today at 5:00 previously which was 0.2%. CANADA GDP (MoM) (Jan) today at 8:30 this time estimated 0.5%, previously which was 0.1%. US Crude Oil Inventories today at 10:30 this time estimated 0.107M, previously which was 1.912M.

Technical Analysis of The Financial Markets

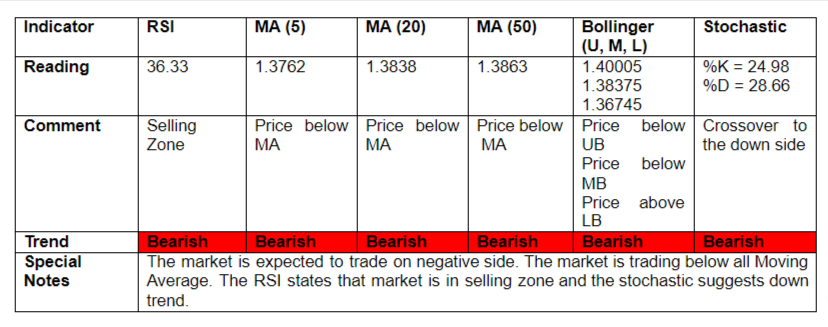

GBPUSD

TRADE SUGGESTION- SELL AT 1.37485, TAKE PROFIT AT 1.37046 AND STOP LOSS AT 1.37789

View Full Report Click here Technical Analysis

.png)

Comments

Post a Comment